21-October-2025

21-October-2025

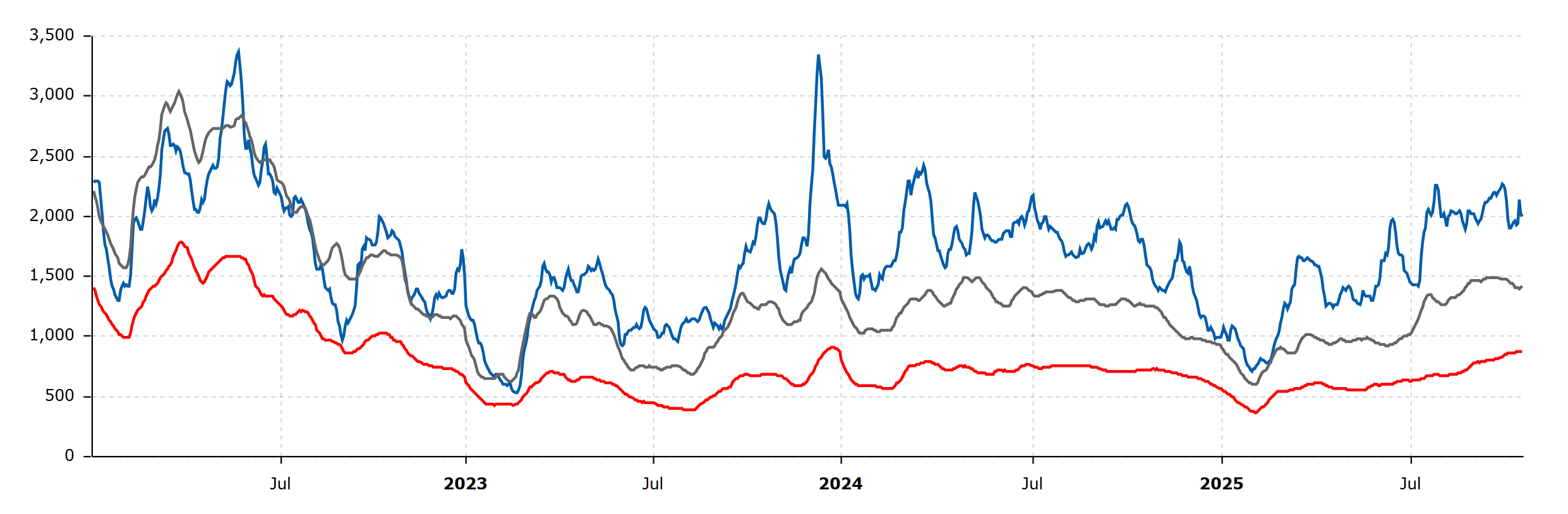

The global freight market has now largely recalibrated to absorb the projected consequences of the port fees enacted by both the United States and China. The renewed escalation in U.S.-China trade hostilities has dampened expectations of any near-term normalization toward a less protectionist trading order. After a relatively stable summer, Beijing’s decision to impose retaliatory port fees on U.S.-linked ships has disrupted global maritime trade flows. The measure directly mirrors the U.S. Trade Representative’s (USTR) earlier action against Chinese vessels. Analysts suggest that China anticipated a possible U.S. escalation and, once it became clear that Washington intended to proceed, chose to respond assertively and proportionally. This latest round of tariff friction has reintroduced a high degree of market uncertainty, once again underscoring how trade policy is being used as both a diplomatic weapon and an instrument of strategic pressure. In many respects, China’s new charges replicate the structure of the American port fee regime. The main distinction lies in China’s “Special Port Fees,” which apply broadly to U.S.-linked ships without singling out specific sectors. By contrast, U.S. measures include a range of exemptions based on ship size and type—covering categories such as LNG carriers and vehicle carriers—designed to cushion domestic industries and stimulate U.S. shipbuilding activity. China’s framework also extends well beyond the relatively small number of U.S.-flagged or U.S.-built ships, encompassing vessels owned or managed by entities with 25% or more American ownership. This clause dramatically expands the total affected fleet. Market observers remain uncertain about how the rule will be applied in practice and await additional clarification from Beijing. China has, however, suggested that certain exemptions—such as for Chinese-built ships or ships ballasting to domestic shipyards for repairs—could reduce the overall burden. Even so, the financial implications are substantial despite the annual limit of five chargeable voyages per ship. A VLCC could face fees approaching $6 million per Chinese port call, rising to nearly $17 million by 2028 at current exchange rates, while a capesize bulk carrier could incur roughly $3 million initially, climbing to about $8 million by 2028. At these levels, calling at Chinese ports becomes commercially prohibitive for U.S.-linked ships, effectively transforming the measure into an exclusionary barrier rather than a simple tariff adjustment. Market reactions were immediate. Forward Freight Agreements (FFAs) and spot freight rates jumped sharply, particularly for larger ship categories. Time Charter Equivalent (TCE) earnings for Very Large Crude Carriers (VLCCs) and capesize bulk carriers surged by roughly 20%, as traders priced in expectations of constrained tonnage access to Chinese ports. While the market’s initial response highlights short-term volatility, it also creates a window for profitable opportunities in the short to medium term. As U.S.-linked ships begin avoiding Chinese cargoes, effective fleet availability is expected to tighten further, lending sustained support to freight earnings rather than producing only a temporary spike. Over time, a structural split in trade routes may emerge, as U.S.-associated tonnage faces persistently higher operational costs compared with non-U.S. ships. From a wider strategic lens, both the United States and China appear to be positioning themselves for a long-term phase of fragmented global trade. China is continuing to expand its Belt and Road Initiative partnerships, deepening ties with South America, the Middle East, and Canada, while also reinforcing domestic production independence. The United States, on the other hand, is redirecting exports of key commodities and energy supplies toward India, Southeast Asia, and Europe. These developments collectively point toward an evolving reconfiguration of global trade routes, as new corridors emerge to offset declining U.S.-China traffic. The renewed tariff confrontation between the world’s two largest economies reinforces the structural drift toward protectionism and geopolitical polarization. This escalation amplifies macroeconomic uncertainty and raises the risk that sustained frictions could suppress global trade growth and potentially trigger a global downturn. For the shipping sector, the outlook for seaborne trade volumes over the medium term will depend on how the situation evolves—particularly on further clarifications from China’s Ministry of Transport regarding the 25% ownership clause—while recent signals of limited exemptions suggest that the scope of enforcement could be narrower than initially feared.

18-October-2025

The Baltic Dry Index (BDI) advanced on Friday, securing a weekly increase driven by solid performance across every bulk carrier segment. The Baltic Dry Index (BDI) moved up by 23 points to reach 2,069 points, marking a 6.9% rise over the week. Tensions between the United States and China have escalated at sea, as both nations introduced reciprocal port charges on each other’s ships, reshaping trade flows, raising freight expenses, and turning global shipping lanes into a new battleground in their economic confrontation. The Baltic Capesize Index (BCI) gained 63 points to settle at 3,121 points, recording an 11.5% increase for the week. Average daily revenues for capesize bulk carriers climbed by $524 to $25,882. The Baltic Panamax Index (BPI) edged up by one point to 1,827 points, ending the week 3.6% higher. The Baltic Panamax Index (BPI) also reached its highest level since 26 September 2025.Typical daily income for panamax bulk carriers rose by $13 to $16,446. The Baltic Supramax Index (BSI) added two points to reach 1,424 points — its strongest level since 7 October 2025 — and recorded a 1.6% weekly improvement.

17-October-2025

The Baltic Dry Index (BDI) inched higher on Thursday, supported by improvements throughout every bulk carrier category.The Baltic Dry Index (BDI) climbed 49 points to reach 2,046 points.On Tuesday, the United States and China implemented fresh port surcharges on maritime transport companies handling cargoes ranging from festive goods to crude oil.The Baltic Capesize Index (BCI) jumped 142 points to 3,058 points.Average daily income for capesize bulk carriers rose by $1,173 to $25,358.The Baltic Panamax Index (BPI) increased by 5 points to 1,826 points, marking its strongest level since 26 September 2025.Daily returns for panamax bulk carriers improved by $47 to $16,433.The Baltic Supramax Index (BSI) advanced 4 points to 1,422 points.

16-October-2025

The Baltic Dry Index (BDI) continued its decline for a second consecutive session on Wednesday, weighed down by softer capesize bulk carrier rates.The Baltic Dry Index (BDI) slipped 25 points to 1,997 points.This followed Tuesday’s performance, which marked the steepest daily drop in two weeks for the Baltic Dry Index (BDI).The Baltic Capesize Index (BCI) retreated 91 points to 2,916 points.Average daily returns for capesize bulk carriers dropped by $753 to $24,185.The Baltic Panamax Index (BPI) edged up 0.3% to 1,821 points.Daily earnings for panamax bulk carriers increased by $49 to $16,386.The Baltic Supramax Index (BSI) added 0.7% to reach 1,418 points.

15-October-2025

The Baltic Dry Index (BDI) retreated on Tuesday, dragged lower by a sharp decline in capesize bulk carrier rates. The Baltic Dry Index (BDI) dropped 122 points to 2,022 points. This fall followed Monday’s strong performance, which had been the best in four months, driven by expectations of higher freight costs after China announced plans to impose new port charges on U.S.-flagged ships. On Tuesday, both the United States and China officially began applying extra port fees to ocean shipping companies. The Baltic Capesize Index (BCI) plunged 385 points to 3,007 points, just one day after recording its strongest daily rise since 11 July 2025.Average daily income for capesize bulk carriers declined by $3,194 to $24,938.The Baltic Panamax Index (BPI) inched up by 0.5% to 1,815 points. Daily earnings for panamax bulk carriers increased by $80 to $16,337.The Baltic Supramax Index (BSI) gained 0.6% to 1,408 points.

14-October-2025

The Baltic Dry Index (BDI) climbed to a two-week peak on Monday, supported by expectations of rising freight expenses after China announced plans to impose extra port charges on U.S.-flagged ships. The Baltic Dry Index (BDI) advanced 208 points to 2,144 points, marking its strongest level since 29 September 2025.The Baltic Capesize Index (BCI) surged 593 points to 3,392 points, also reaching its highest since 29 September 2025.Average daily revenues for capesize bulk carriers jumped by $4,916 to $28,132.The Baltic Panamax Index (BPI) gained 42 points to 1,806 points, with average daily earnings for panamax bulk carriers improving by $384 to $16,257.The Baltic Supramax Index (BSI) edged down 2 points to 1,400 points.

13-October-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier segment went through a split week, recording early strength before momentum faltered as market sentiment weakened. The Baltic Capesize Index (BCI) 5TC began the week at $23,453, reached its midweek high at $24,252, and ended slightly lower at $23,216. Consistent miner activity across the Pacific basin kept early sentiment buoyant, driving Baltic Capesize Index (BCI) C5 rates above $9.50. Meanwhile, routes from East Coast South America (ECSA) and West Africa (WAFR) to China struggled with limited cargo flow and a scarcity of new fixtures on the Baltic Capesize Index (BCI) C3 route, highlighting subdued demand. In the North Atlantic, the capesize bulk carrier market initially gained traction with firm transatlantic and fronthaul fixtures, though enthusiasm faded toward the weekend as trading volumes dipped. Despite overall demand for capesize bulk carriers staying healthy, renewed geopolitical frictions weighed on sentiment as China imposed retaliatory port charges on U.S.-linked ships following similar U.S. tariffs, intensifying global trade tensions.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market started the week sluggishly but gradually picked up steam as optimism returned to both Atlantic and Pacific basins. The North Atlantic saw notable momentum shifts in favor of shipowners, fueled by rising cargo volumes from the U.S. Gulf (USG) and U.S. East Coast (USEC) for both fronthaul and transatlantic routes. East Coast South America (ECSA) witnessed a short-lived midweek boost, with an 81,000 DWT kamsarmax bulk carrier reportedly earning $17,500 on a Singapore-delivery basis for a trip via Argentina to China, redelivery end-October 2025. With regional holidays behind them, Asian markets reopened on a more confident note, supported by a spike in demand out of the North Pacific (NoPac), where multiple 82,000 DWT kamsarmax bulk carriers secured $16,000 for China delivery runs. Australian-origin cargoes kept a steady flow, allowing panamax bulk carrier freight rates to rise gradually as the week progressed, signaling a modest advantage for shipowners. For period activity, one 82,000 DWT kamsarmax bulk carrier was heard fixed around $15,500 delivery China for a 10–12 month term.

Ultramax / Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

Asian holidays curtailed trading momentum in the ultramax and supramax bulk carrier market, leading to a subdued week dominated by limited fresh cargoes and oversupply of prompt tonnage. The previously active demand from the U.S. Gulf (USG) faded, resulting in a softening of rates. Similarly, East Coast South America (ECSA) lost pace, with a 63,000 DWT ultramax bulk carrier securing about $15,500 plus a $550,000 ballast bonus for a voyage to China. Conversely, the European market remained resilient, as a 63,000 DWT ultramax bulk carrier fixed near $32,000 from the United Kingdom to Turkiye. In Asia, the week began quietly, but a slight uptick in confidence emerged by the close. Backhaul opportunities were scarce, though a 63,000 DWT ultramax bulk carrier open in North China fixed near $13,000 for a trip to Nigeria, while another 63,000 DWT ultramax bulk carrier open in Bangladesh was reportedly taken at $14,500 for a voyage via Indonesia to the West Coast of India (WCI).

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The handysize bulk carrier segment displayed a mixed performance this week, marked by minimal fluctuations across regions. The European and Mediterranean markets held their ground with incremental gains and firm sentiment. Illustratively, a 38,000 DWT handysize bulk carrier was reported fixed for a trip from the Netherlands via the UK to Turkiye at roughly $25,500. In the Americas, the East Coast South America (ECSA) and U.S. Gulf (USG) handysize bulk carrier markets remained stable, underpinned by steady demand and marginally improved rates. Fixtures included a 36,000 DWT handysize bulk carrier open in Colombia fixed for a voyage via Brazil to Norway at around $25,000, and a 40,000 DWT handysize bulk carrier open in the Southwest Passage fixed at about $23,500 for a trip via the U.S. Gulf (USG) to the Dominican Republic. In Asia, the holiday slowdown in China and South Korea dampened activity, though freight rates stayed firm overall. One 40,000 DWT handysize bulk carrier was reportedly fixed at around $14,000 for a North China delivery via Japan to Mexico’s West Coast.

9-October-2025

The Baltic Dry Index (BDI) advanced on the back of firm gains in both capesize and panamax bulk carrier segments. The Baltic Dry Index (BDI) climbed 16 points to reach 1,963 points, marking its strongest level since 1 October 2025. The Baltic Capesize Index (BCI) extended its upward momentum for a fourth consecutive session, gaining 39 points to settle at 2,924 points—its highest level in more than a week. Average daily earnings for capesize bulk carriers improved by $325, reaching $24,252. Meanwhile, the Baltic Panamax Index (BPI) also moved higher, rising 30 points to 1,695 points, its best level since early October 2025. Average daily earnings for panamax bulk carriers edged up by $264 to $15,252. In contrast, the Baltic Supramax Index (BSI) lost ground, slipping 14 points to 1,411 points—its weakest position in over a month.

4-October-2025

The Baltic Dry Index (BDI) slipped further on Friday, ending the week with its most severe decline in over eight months as freight market sentiment deteriorated across all major bulk carrier segments. The Baltic Dry Index (BDI) dropped 8 points to close at 1,901 points, marking its weakest level since 21 August 2025. On a weekly basis, the Baltic Dry Index (BDI) plunged 15.8%, its steepest fall since late January 2025, reflecting a widespread correction in the dry bulk freight market. The Baltic Capesize Index (BCI) managed to halt a five-day slide, adding 4 points to reach 2,724 points, although it still recorded a substantial 24.9% decline over the week. Average daily time charter equivalent earnings for capesize bulk carriers edged up by $33 to $22,595. The Baltic Panamax Index (BPI) extended its downward momentum, slipping 23 points to 1,662 points — the lowest reading since 20 August 2025 — and ending the week 9.3% lower. Average daily earnings for panamax bulk carriers decreased by $203 to $14,961. The Baltic Supramax Index (BSI) also weakened, easing by 9 points to 1,447 points and registering a 2.2% weekly loss, underscoring the persistent pressure on smaller bulk carrier categories as market activity continued to soften.

3-October-2025

2-October-2025

The Baltic Dry Index (BDI) retreated to its weakest level in almost a month on Wednesday as freight rates declined across all major bulk carrier segments. The Baltic Dry Index (BDI) plunged 154 points to 1,980 points, marking its lowest value since 5 September 2025. The Baltic Capesize Index (BCI) also lost significant ground, falling 415 points to 2,890 points — its lowest level in nearly four weeks — amid easing charter activity and reduced demand for long-haul cargoes. Average daily earnings for capesize bulk carriers dropped sharply by $3,437 to $23,968. The Baltic Panamax Index (BPI) continued its downward momentum, slipping 51 points to 1,725 points, the lowest figure recorded since 3 September 2025. Average daily income for panamax bulk carriers fell by $464 to $15,521 as weaker cargo volumes pressured spot market returns. The Baltic Supramax Index (BSI) also trended lower, edging down 6 points to 1,467 points, reflecting sustained softness in the smaller bulk carrier sector and subdued demand across regional trades.

1-October-2025

The Baltic Dry Index (BDI) slipped to its lowest point in more than two weeks on Tuesday as freight rates weakened across every bulk carrier segment, although the Baltic Dry Index (BDI) still managed to close its second straight quarter with a strong gain. The Baltic Dry Index (BDI) declined by 86 points to 2,134 points, its weakest reading since 12 September 2025. Despite this pullback, the Baltic Dry Index (BDI) recorded an overall rise of 5.4% for the month and an impressive 43.3% increase for the quarter, highlighting the underlying resilience of the dry bulk market. The Baltic Capesize Index (BCI) also retreated, shedding 219 points to 3,305 points — its lowest level in almost two weeks — though it still ended the month roughly 13% higher as capesize market sentiment remained relatively strong. Average daily time charter equivalent earnings for capesize bulk carriers fell by $1,823 to $27,405. The Baltic Panamax Index (BPI) continued its downward trend, dropping 42 points to 1,776 points, marking its lowest point since 4 September 2025. For the month, the Baltic Panamax Index (BPI) slipped 3.8%, with average daily earnings for panamax bulk carriers decreasing by $373 to $15,985. The Baltic Supramax Index (BSI) also moved lower, easing by 5 points to 1,473 points — its weakest since 8 September 2025 — as smaller bulk carrier segments remained under pressure due to subdued regional demand and softer chartering activity.

30-September-2025

The Baltic Dry Index (BDI) started the week on a weaker note Monday, declining as freight rates softened across all bulk carrier segments. The Baltic Dry Index (BDI) slipped by 39 points to 2,220 points, reflecting a broad pullback in market activity and sentiment. The Baltic Capesize Index (BCI) registered the largest drop among the segments, falling 103 points to 3,524 points, as average daily time charter equivalent earnings for capesize bulk carriers fell by $848 to $29,228. The Baltic Panamax Index (BPI) also moved lower, declining 14 points to 1,818 points, with average daily returns for panamax bulk carriers down by $126 to $16,358. The Baltic Supramax Index (BSI) inched down by 1 point to 1,478 points — its lowest level since 9 September 2025 — as smaller bulk carrier categories continued to experience muted chartering demand and reduced voyage activity.

The capesize bulk carrier segment sustained a generally positive trajectory throughout the week, though market energy subsided toward the close. The Baltic Capesize Index (BCI) 5TC began the week just below $28,000, climbing past the $30,000 mark before tapering off slightly to conclude at $30,076. Within the Pacific capesize bulk carrier market, mining activity was active early in the week, ranging from moderate to heavy participation, but by Friday only one miner was reported fixing cargo at $10.80 per ton. Market talk of deals done around $11.20 lacked confirmation, while another was rumored to have been finalized below $11.00. Even with Typhoon Ragasa sweeping through South China midweek, the region’s capesize bulk carrier rates remained largely stable, underpinned by a constrained supply of prompt tonnage. In the Atlantic capesize bulk carrier market, the Baltic Capesize Index (BCI) C3 route advanced to about $26.00 midweek but slipped back to $25.935 by Friday as fresh demand waned and fixtures emerged at marginally softer numbers. The North Atlantic capesize bulk carrier market recorded solid progress earlier in the week, with fronthaul routes surpassing the $50,000 level and transatlantic values strengthening, though enthusiasm cooled as the week drew to a close.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier segment opened the week on firm ground, maintaining the upward tone that carried over from the previous week, particularly in the Asian sector. However, the Atlantic panamax bulk carrier market started cautiously, facing limited new cargo inquiries in the North Atlantic amid a rising number of available ships. South America’s panamax bulk carrier activity was stable rather than lively, with early-October arrivals continuing to secure premiums over index-linked dates, which fluctuated between the low $15,000s and $16,000. In the Asian panamax bulk carrier arena, consistent Australian mineral demand lent additional support, with average time charter equivalents settling near $15,500. The NoPac (North Pacific) market traded slightly below this due to muted cargo flow. Indonesian demand, however, remained resilient and absorbed a good portion of tonnage in Southeast Asia. Period employment also featured, as an 82K DWT kamsarmax bulk carrier with delivery in Japan was reportedly fixed at $15,500 for a one-year time charter.

Ultramax / Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier sector displayed a split performance, with the Atlantic region continuing to strengthen while the Asian side lost momentum. The Atlantic ultramax/supramax bulk carrier market maintained firm sentiment amid steady chartering activity. A 63K DWT ultramax bulk carrier open in the US Gulf (USG) for a trip to East Coast India (ECI) fetched about $34,500. Another 63K DWT ultramax bulk carrier open in Brazil for a China voyage was fixed at $17,500 plus a $750,000 ballast bonus (BB). From the Baltic ultramax/supramax bulk carrier market, a 63K DWT ultramax bulk carrier open in East Mediterranean (EMED) for a run via the Baltic to China, routing through the Cape of Good Hope (COGH), was concluded around $21,500. Conversely, the Asian ultramax/supramax bulk carrier market continued to soften, weighed by limited demand and an oversupply of tonnage. A 53K DWT supramax bulk carrier open in Singapore via Indonesia to China achieved approximately $14,000. In contrast, Indian Ocean activity edged upward, with a 63K DWT ultramax bulk carrier open South Africa (SAFR) to China reportedly fixed at about $20,000 plus a $200,000 ballast bonus (BB).

The handysize bulk carrier market closed the week on a constructive note, with firming rates across nearly all major trading zones. The Continent–Mediterranean handysize bulk carrier market retained a solid tone, supported by balanced supply-demand fundamentals, particularly in the North Continent and Baltic, where multiple fixtures were sealed at competitive levels. A 35K DWT handysize bulk carrier open Poland for a Baltic–West Africa (WAFR) voyage fetched roughly $18,500. Despite limited reported activity, East Coast South America (ECSA) and US Gulf (USG) markets saw steady improvement, aided by tightening tonnage. A 38K DWT handysize bulk carrier open in West Africa (WAFR) for a voyage via Argentina to Turkiye was booked around $16,500, while a 39K DWT handysize bulk carrier open in the US Gulf (USG) for a trip to Egypt Mediterranean fixed close to $23,500. In Asia, handysize bulk carrier sentiment remained stable, with balanced cargo volumes preventing major fluctuations. A 38K DWT handysize bulk carrier open Vietnam for a run to West Coast India (WCI) reportedly fixed at approximately $17,000.

26-September-2025

The Baltic Dry Index (BDI) advanced to its strongest level in about a year and a half on Thursday, buoyed by firmer freight rates across most bulk carrier segments. The Baltic Dry Index (BDI) increased by 26 points to reach 2,266 points, its highest figure since March 2024. The Baltic Capesize Index (BCI) climbed 68 points to 3,641 points, as average daily returns for capesize bulk carriers rose by $558 to $30,194. The Baltic Panamax Index (BPI) gained 11 points to stand at 1,835 points, with average daily earnings for panamax bulk carriers edging up by $103 to $16,517. The Baltic Supramax Index (BSI) remained unchanged at 1,483 points

24-September-2025

The Baltic Dry Index (BDI) moved higher on Tuesday, driven by renewed strength in capesize bulk carrier earnings. The Baltic Dry Index (BDI) climbed 28 points to 2,200 points. The Baltic Capesize Index (BCI) surged 104 points to 3,469 points as average daily returns for capesize bulk carriers rose by $867 to $28,770. The Baltic Panamax Index (BPI) declined 23 points to 1,799 points, hitting its lowest reading since 4 September 2025, with average daily revenues for panamax bulk carriers slipping by $210 to $16,190. The Baltic Supramax Index (BSI) held firm at 1,486 points.

23-September-2025

The Baltic Dry Index (BDI) declined on Monday, pressured by softer sentiment across all major bulk carrier types. The Baltic Dry Index (BDI) dropped 31 points to close at 2,172 points. The Baltic Capesize Index (BCI) broke its six-day upward streak, sliding 72 points to 3,365, as average daily earnings for capesize bulk carriers decreased by $601 to $27,903. The Baltic Panamax Index (BPI) weakened by 23 points to 1,822 points, touching its lowest mark since 5 September 2025, with average daily revenues for panamax bulk carriers down by $203 to $16,400.The Baltic Supramax Index (BSI) slipped 3 points to 1,486 points.

18-September-2025

The Baltic Dry Index (BDI) advanced for a fourth day in a row on Wednesday, moving close to a two-month peak as stronger capesize bulk carrier activity lifted the market, with the index rising 26 points to reach 2,180 points, its firmest level since 28 July 2025. The Baltic Capesize Index (BCI) surged by 111 points to 3,300 points, the highest level recorded since 14 August 2025, while daily hire rates for capesize bulk carriers improved by $923 to stand at $27,366. Iron ore contracts slipped on key exchanges during Wednesday’s session, weighed down by increasing exports from Brazil, the world’s top supplier, alongside a restrained demand outlook from the steel sector. Meanwhile, the Baltic Panamax Index (BPI) declined for the third consecutive day, falling 45 points to 1,923 points, the lowest reading since 8 September 2025, with average daily returns for panamax bulk carriers dropping $404 to $17,308. The Baltic Supramax Index (BSI) inched upward by 1 point, closing at 1,492 points.

28-August-2025

Supramax bulk carrier spot freight rates have surged to their highest level in 15 months, now exceeding the earnings of larger panamax bulk carriers as the start of the US grain export season draws near. Spot rates for supramax and ultramax bulk carriers have reached levels not seen since May 2024, with tightening vessel supply meeting consistent fresh demand from charterers. This upswing in the market coincides with the imminent kickoff of US corn and soybean exports, a key period that will indicate to what extent Brazil has overtaken the United States as China’s dominant soybean supplier. The composite index of average ultramax spot rates, covering 11 principal trading routes, rose by $126 on Wednesday to $18,291 per day, based on a 63K DWT ultramax bulk carrier.

24-July-2025

Capesize bulk carrier spot rates surged by 14% in a single day, reaching their highest level in 2025 despite subdued global steel production data, as tightening tonnage supply and steady cargo volumes at export hubs fueled a sharp rally on Thursday, with Baltic Exchange panellists raising their average rate assessment by 13.5%, marking one of the largest overnight gains in the index this year, as capesize bulk carrier spot rates increased by $3,741 to reach $31,429 per day, the highest level recorded since 2 July 2024.

22-July-2025

The Baltic Dry Index (BDI) declined by 36 points to 2,016 on Monday, ending a seven-session winning streak as weaker rates for capesize and panamax bulk carriers exerted pressure. The Baltic Capesize Index (BCI) dropped 103 points to 2,981, with average daily earnings for capesize bulk carriers down $855 to $24,720. The Baltic Panamax Index (BPI) slipped 4 points to 1,915, while average daily earnings for panamax bulk carriers fell $40 to $17,232. The Baltic Supramax Index (BSI) remained unchanged at 1,346.

21-July-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier market recorded a significant and consistent uptrend this week, supported by strong sentiment and rising momentum across both the Atlantic and Pacific regions. The Baltic Capesize Index (BCI) 5TC jumped by $5,942 to settle at $25,575, driven by tightening tonnage availability and increased cargo flows, particularly from Brazil and West Africa to China. In the Pacific, the Baltic Capesize Index (BCI) C5 route saw rates steadily increase amid strong demand from major miners, intensified operator activity, and a shrinking tonnage list. A burst of mid-week fixtures propelled rates close to $9.80 before easing slightly to the $9.50–$9.60 range by week’s close. The Atlantic market also saw elevated activity, especially on the Baltic Capesize Index (BCI) C3 route, where rates climbed from $21.50 to $23 for end-August laycans, supported by firm enquiry and a tightening list of ballasters. In the North Atlantic, sentiment remained optimistic, with tight tonnage and firm fixtures, including a reported fronthaul deal close to $50,000/day, underlining robust demand.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market experienced a mixed week. Although it began on a solid note, gains gradually faded as charterers paused to reassess, but fundamentals strengthened again by the end of the week, with supply appearing tight in some regions and rates holding steady. In the Atlantic, activity in the North remained subdued, while in the South, a kamsarmax of 82,000 DWT was fixed at $18,000 for a voyage from Singapore via Argentina to China. In Asia, demand from Indonesia and Australia remained active, with several fixtures around $16,000 on standard panamax bulk carrier tonnage for round voyages. Period business improved midweek, highlighted by an 82,000 DWT kamsarmax fixed from Japan at $15,500 for 5 to 7 months.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier market started the week on a strong note, with limited vessel availability and increasing demand pushing rates higher in key regions. However, as the week progressed, this momentum eased and rates appeared to reach a peak. In the Atlantic, ultramax bulk carriers fixing from the US Gulf achieved around $30,000 for fronthaul and similar levels for transatlantic routes. A 63,000 DWT ultramax from Argentina to Bangladesh was fixed at $19,000 plus a $900,000 ballast bonus. In Asia, firm backhaul demand from northern areas kept rates elevated, with a 63,000 DWT ultramax fixing at $17,000 for a trip from Singapore via Indonesia to West Coast India. Increased demand from South America supported Indian Ocean rates, with a 62,000 DWT ultramax fixed from South Africa to China at $19,000 plus $900,000 ballast bonus. Period interest emerged early but weakened later in the week; a 63,000 DWT ultramax open West Coast India fixed at $14,500 for a short period, while another of the same size open on Mexico’s East Coast secured $15,000 for a 9–11 month period.

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The handysize bulk carrier segment saw mostly positive developments, with freight rates strengthening across many loading areas. Although fixture activity remained limited, the Continent–Mediterranean market showed gradual improvement, driven by regional positioning. A 38,000 DWT handysize vessel open Algeria fixed around $12,000 for a trip within the Mediterranean. In the South Atlantic and US Gulf, rates remained firm due to steady demand and positive sentiment. A 39,000 DWT handysize bulk carrier fixed from Brazil to Algeria at $14,500, while another 39,000 DWT unit was placed on subjects for a trip via the US Gulf to Panama East Coast at approximately $17,000. The Asian market stayed active, supported by strong cargo flows and tight vessel availability, with a 40,000 DWT handysize fixed from Bangladesh to ARAG at $13,000. Period interest remained healthy across both basins, with a 35,000 DWT unit open US Gulf fixed at $11,500 for a short term, and a 37,000 DWT open in Egypt fixed at $12,500 for a similar period.

10-July-2025

The Baltic Dry Index (BDI) declined on Wednesday, shedding 8 points to settle at 1,423, driven by weaker rates for capesize vessels. The Baltic Capesize Index (BCI) dropped by 97 points to 1,654, extending its losing streak to seventeen sessions, with average daily earnings falling by $806 to $13,715. On the other hand, the Baltic Panamax Index (BPI) climbed 52 points to 1,621, its highest level since August 7, 2024, as average daily earnings rose by $469 to $14,590. The Baltic Supramax Index (BSI) also advanced, gaining 26 points to reach 1,151.

9-July-2025

The Baltic Dry Index (BDI) dropped 5 points to 1,431 on Tuesday, its lowest level since June 3, 2025, primarily due to a decline in capesize bulk carrier rates. The Baltic Capesize Index (BCI) fell for the sixteenth consecutive session, down 74 points to 1,751, with average daily earnings for capesize vessels decreasing by $611 to $14,521. In contrast, iron ore futures rebounded, supported by strong demand from China, although gains were capped by U.S. President Donald Trump’s warning on Monday of steep tariffs taking effect on August 1, 2025—prompting Japan and South Korea to announce negotiations with the U.S. on Tuesday. Meanwhile, the Baltic Panamax Index (BPI) rose 38 points to 1,569, the highest since August 12, 2024, with panamax vessel daily earnings up $344 to $14,121, and the Baltic Supramax Index (BSI) climbed 25 points to 1,125.

8-July-2025

The Baltic Dry Index (BDI) remained unchanged at 1,436 points on Monday, as gains in the panamax and supramax segments offset continued weakness in the capesize sector, where the Baltic Capesize Index (BCI) fell for the fifteenth consecutive session, dropping 30 points to 1,825, with average daily earnings down $250 to $15,132. Iron ore futures also declined due to renewed demand concerns, driven by production restrictions in China’s key steel hub and uncertainty surrounding U.S. trade policy. Meanwhile, the Baltic Panamax Index (BPI) rose 11 points to 1,531—its highest level since September 25, 2024—with daily earnings for panamax vessels up $94 to $13,777, and the Baltic Supramax Index (BSI) gained 19 points to 1,100, its highest since November 6, 2024. Adding to market uncertainty, U.S. President Donald Trump announced he is close to finalizing several trade deals and will notify countries of higher tariffs by July 9, 2025, with the new rates set to take effect on August 1.

7-July-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier market showed signs of stabilisation this week after a recent period of softness. Gains were recorded in the Pacific basin, while the Atlantic basin appeared more balanced. In the Pacific basin, the Baltic Capesize Index (BCI) C5 route saw steady improvement, with rates climbing from $6.90 at the start of the week to $7.44 by the end. Increased capesize bulk carrier fixing activity from all three major miners and rising volumes of iron ore and coal contributed to a tightening tonnage list and stronger sentiment. The Atlantic basin began the week on a slow note but gained traction mid-week. On the Brazil–China, Baltic Capesize Index (BCI) C3 route, initial weakness gave way to firmer activity, with a fixture concluded at around $19.50 for end-July 2025 dates. However, the extended capesize bulk carrier ballaster list continued to cap optimism for forward earnings. The North Atlantic capesize bulk carrier market experienced a slight rise in transatlantic and fronthaul activity, though rates remained relatively steady.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market returned largely flat results this week, with East Coast South America (ECSA) being a notable exception. From mid-week, East Coast South America (ECSA) saw a gradual uptick in demand and improved fundamentals. In contrast, the North Atlantic underperformed, with transatlantic panamax bulk carrier rates varying significantly depending on the delivery location. Panamax bulk carriers open in the Continent continued to underachieve relative to those positioned in the West Mediterranean (WMED). Panamax bulk carrier fronthaul activity was marginally better, supported by consistent grain and mineral exports from North America. 82,000 DWT kamsarmax bulk carrier fixed delivery Continent via Colombia East Coast to China at $21,250. In the Pacific basin, panamax bulk carrier activity remained healthy across major loading regions, though demand was steady rather than strong. Panamax bulk carrier rates ex-Australia held firm, with an 82,000 DWT kamsarmax bulk carrier open in Japan fixed for an Australia–Japan round at $11,500. Period interest was subdued; however, a 1-year time charter was reported for an 82,000 DWT kamsarmax bulk carrier open in Southeast Asia (SEA) at $12,000.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier market had a positive week, with increased demand across key regions. In the Atlantic, the US Gulf saw improved sentiment, with charterers reportedly bidding around $25,000 for transatlantic voyages to attract interest from 63,000 DWT ultramax bulk carrier owners. A 56,000 DWT supramax bulk carrier open in the Black Sea was fixed via Romania to Jordan at $14,500. Asia saw a rebound in demand across both southern and northern regions, particularly for backhaul cargoes. Notable fixtures included a 63,000 DWT ultramax bulk carrier fixed from North China to Turkiye at $17,000 and a 61,000 DWT ultramax bulk carrier from Hong Kong to Singapore at $12,000. In the Indian Ocean, momentum continued, with a 63,000 DWT ultramax bulk carrier fixed from South Africa (SAF) to China at $16,000 plus a $160,000 ballast bonus. Period activity remained stable, with a 63,000 DWT Ultramax open in the UAE fixed for 5–7 months at $15,000.

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The Handysize market remained subdued this week, with slowing activity across the Continent and Mediterranean as many participants attended shipping events. A 34,000 DWT handysize bulk carrier was fixed from Algeria to the US Gulf (USG) at $7,000. In the US Gulf, the market remained soft due to limited fixing and an oversupply of open vessels. A 39,000 DWT handysize bulk carrier was fixed from the US East Coast (USEC) via the US Gulf (USG) to Morocco at $15,000. The South Atlantic remained steady, with little change in freight levels; a 38,000 DWT handysize bulk carrier fixed from Brazil to Algeria at $17,500. The Asian market showed minimal movement, with weak fundamentals and flat sentiment. A 41,000 DWT handysize bulk carrier open South Africa (SAF) to Pakistan fixed around $22,500.

5-July-2025

The Baltic Dry Index (BDI) rose slightly by 2 points to 1,436, snapping a seven-day losing streak, but still recorded its third consecutive weekly decline with a 5.6% drop, driven by weakness in capesize bulk carrier rates. The Baltic Capesize Index (BCI) continued its downward trend, falling 39 points to 1,855 and posting a steep weekly loss of 16.4%, with average daily earnings for capesize vessels down by $323 to $15,382. Iron ore futures extended gains for a second straight week, supported by improved market sentiment after Chinese authorities called for curbs on aggressive price-cutting, urging stricter competition controls among domestic companies. In contrast, the Baltic Panamax Index (BPI) climbed 13 points to 1,520—its highest level since September 2024—ending the week 1.1% higher, with average daily earnings rising by $118 to $13,683. The Baltic Supramax Index (BSI) also advanced, gaining 29 points to 1,081 and marking its fourth consecutive week of growth.

4-July-2025

The Baltic Dry Index (BDI) declined for the seventh consecutive session on Thursday, weighed down by reduced demand for capesize bulk carriers. The index fell by 9 points, or 0.6%, to 1,434, its lowest level since June 3, 2025. The Baltic Capesize Index (BCI) dropped 64 points to 1,894, hitting its lowest point since May 28. Average daily earnings for capesize bulk carriers decreased by $537 to $15,705. Iron ore futures climbed to a more than one-month high, driven by China’s renewed efforts to curb low-price competition and reduce industrial overcapacity. On Tuesday, China’s top leadership pledged to strengthen regulations on aggressive price-cutting by Chinese companies, as China continues to battle persistent deflationary pressures. Meanwhile, the Baltic Panamax Index (BPI) gained 15 points to reach 1,507, with average daily earnings for panamax bulk carriers rising by $141 to $13,565. The Baltic Supramax Index (BSI) also advanced, climbing 21 points to 1,052 — its highest level in over seven months.

30-June-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier market recorded a notable decline this week as sentiment deteriorated due to persistently weak activity across both the Atlantic and Pacific basins. The extended absence of all major Baltic Capesize Index (BCI) C5 miners in the Pacific led to an oversupply of capesize bulk carriers, further weakening sentiment and dragging Baltic Capesize Index (BCI) C5 rates down to the mid-high $6.00 range, well below the previous $10.00–$11.00 levels. Although East Coast Australia coal cargoes offered limited support, the lack of iron ore movement continued to weigh heavily. The South Brazil and West Africa to China routes showed occasional strength, but rate levels steadily declined, with Baltic Capesize Index (BCI) C3 fixtures falling into the very low $20.00s. The North Atlantic capesize bulk carrier market was comparatively steady due to fresh cargo and a balanced list, though activity remained thin and rates softened towards the week’s close. By the end of the week, the Baltic Capesize Index (BCI) 5TC fell to $18,408.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market had an eventful week, with the North Atlantic runs generating varying opinions on value, particularly between West Mediterranean and Continent deliveries. Nonetheless, overall sentiment stayed firm. South America saw strong activity, with pre-index arrival positions achieving rates above Baltic Panamax Index (BPI) levels, while only a few deals were concluded for the second half of July, generally around $15,500 plus $550,000 APS load port. In Asia, there was healthy volume from Australia, and activity from North Pacific (NOPAC) picked up by week’s end, with rates around $13,000 for 82K DWT kamsarmax bulk carriers on index-length trips. Tonnage remained tight in the south, supporting a $1,000 rate increase over the week to approximately $11,750 ex-Indonesia. Period business was limited but included a 95K DWT unit delivering in Japan that was fixed at $11,250 for 4 to 7 months.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier market remained largely positional this week. In the Atlantic, lack of fresh enquiry from the US Gulf (USG) caused rates to ease, with a 58K DWT supramax bulk carrier fixed from USG to West Africa at about $20,000. The South Atlantic saw continued activity, although fixing details were scarce. In Asia, the market improved with increased demand from Indonesia and North Pacific (NOPAC); a 63K DWT ultramax bulk carrier was fixed from Singapore via Indonesia to China at $13,500, while a 55K DWT supramax bulk carrier open in China was fixed to China at $12,000. The Indian Ocean experienced firmer demand from South Africa (SAFR), with a 63K DWT ultramax bulk carrier open SAFR to China fixed at $14,000 plus $140,000 BB. Period business remained active, with a 63K DWT ultramax bulk carrier open China fixed for one year at $13,500.

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The handysize bulk carrier market showed a mixed tone this week, with the Continent and Mediterranean remaining soft and charter rates slipping further. A 35K DWT handysize bulk carrier open in Marmara was fixed via Romania to Algeria at about $6,500. The South Atlantic maintained some strength, although activity from the U.S. Gulf (USG) slowed approaching the weekend. Notable fixtures included a 38K DWT handysize bulk carrier fixed from Colombia East Coast to ARAG at $17,500 and another of the same size fixed from USG to ARAG at $20,000. In Asia, handysize bulk carrier rates stayed steady, supported by balanced supply-demand conditions, with a 35K DWT handysize bulk carrier fixed from Vietnam via South China to Southeast Asia at $12,500. Period interest was active in both basins, with a 38K DWT handysize bulk carrier open in USG placed on subjects for a short period and a 40K DWT handysize bulk carrier open in Hong Kong fixed on a period basis at an index-linked rate of 118%.

26-June-2025

The Baltic Dry Index (BDI) declined by 16 points to 1,665 on Wednesday, reaching its lowest level since 6 June 2025, as a drop in capesize bulk carrier freight rates continued to weigh on the market; the Baltic Capesize Index (BCI) fell for the seventh consecutive session, shedding 93 points to 2,724, its lowest since 4 June 2025, with average daily earnings for capesize bulk carriers down by $768 to $22,592; in contrast, the Baltic Panamax Index (BPI) rose for the third straight session, adding 41 points to 1,425, with panamax average daily earnings increasing by $370 to $12,825; the Baltic Supramax Index (BSI) also advanced, gaining 11 points or 1.1% to 994.

18-June-2025

The global dry bulk fleet is set to experience a significant reduction in younger, more efficient ships, with projections indicating a 22% decline in ships under 15 years of age by 2028. This expected contraction reflects a structural change resulting from past imbalances in newbuilding activity, coupled with an aging fleet increasingly unfit to meet current efficiency and emissions requirements. A distinct split is emerging within the fleet: on one side, a growing segment of modern, regulation-compliant ships, and on the other, a substantial pool of older, slower, less efficient ships that are being increasingly burdened by environmental regulations. This divergence is expected to intensify over the next five years. The commercial edge of newer ships is likely to grow as scrapping accelerates, driven by mounting regulatory and commercial pressures on aging tonnage. Many older ships are nearing their third special survey just as environmental compliance is tightening and dry dock slots are becoming limited, forcing owners to decide between costly upgrades or relegating these ships to lower-margin trades that may soon face oversupply. With newer ships being prioritized for long-term charters and environmentally aligned operations, the segmentation of the fleet is already influencing commercial dynamics. Modern tonnage is earning premium charter rates and drawing attention from major commodity traders and publicly listed operators, while older ships are increasingly relegated to shorter regional routes, often within jurisdictions with more relaxed oversight. The tightening supply picture—driven by scrapping, aging tonnage, and regulatory change—is expected to play a central role in defining future market opportunities. As the shipping industry moves toward a leaner, more efficient model, success will depend on adopting a data-centric approach, favoring those with the sharpest market insight.

16-June-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier market showed a stable yet layered performance throughout the week, beginning quietly due to European holidays but gradually picking up momentum. In the Pacific, the Baltic Capesize Index (BCI) C5 West Australia to China route experienced sustained demand from major Australian miners, with fixture levels rising from below $10.00 early in the week to a peak of $11.01 by Friday. The Atlantic basin led the uptrend, outperforming the Pacific, as tightening tonnage in the North Atlantic and firm demand on the Baltic Capesize Index (BCI) C3 Brazil to China route propelled bid and offer levels upward, with offers on Thursday reaching $27.00–$28.00 for early July 2025 laycans. However, the Baltic Capesize Index (BCI) C3 slowed on Friday, particularly for index laycan business. The North Atlantic retained strength due to a constrained capesize bulk carrier tonnage supply and solid inquiry levels. By the end of the week, the Baltic Capesize Index (BCI) 5TC surged by nearly $6,000, rising from $24,961 on Monday to close at $30,866.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market recorded notable gains during the week, driven by strong grain-related demand in the Atlantic basin, especially in North and South America, for late June 2025 arrivals. Despite robust performance, the trans-Atlantic market diverged into a two-tiered structure, with ships positioned in the West Mediterranean (WMED) commanding stronger rates than those in the Continent. A kamsarmax bulk carrier of 84K DWT open in Spain fixed at about $21,500 for a Colombia East Coast to South China route. In the Pacific, demand ex Australia drove activity, complemented by an improving East Coast South America (ECSA) market that helped maintain regional strength. A kamsarmax bulk carrier of 82K DWT open in China was fixed via Australia to Japan at roughly $13,500. Period charter activity also increased, including a report of an 82K DWT kamsarmax bulk carrier fixed from China at around $13,000 for a 3/5-month period.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier sector showed a clear divergence between basins. The Atlantic basin saw firm conditions, with tightening tonnage in the U.S. Gulf (USG) and increased activity in South America supporting rate strength. Fixtures included a 58K DWT supramax bulk carrier open in SW Passage fixed at around $20,000 via USG to Japan, and a 63K DWT ultramax bulk carrier open in Tema, West Africa (WAFR), fixed via Brazil to China at around $16,500. In contrast, the Pacific basin remained weak amid scarce fresh inquiry and mounting prompt tonnage. A 60K DWT ultramax bulk carrier open in Indonesia was fixed to China for about $11,500, while a 55K DWT supramax bulk carrier open in Indonesia to West Coast India (WCI) was reported at around $13,000. A slight uptick in period demand was noted, including a newbuilding 64K ultramax bulk carrier open in the Philippines fixed for one year’s trading at about $13,000.

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The handysize bulk carrier market delivered a mixed performance this week with limited changes in both hemispheres. In the Continent and Mediterranean, new demand and higher activity were observed, though rates remained mostly flat. A 40K DWT handysize bulk carrier open in Egypt was fixed to ARAG at around $10,000. In the South Atlantic, the handysize market held steady with little movement, while the U.S. Gulf (USG) showed firm fundamentals despite a lack of significant fixture reports, supported by stable cargo flows. The Pacific market was largely unchanged, with supply and cargo availability remaining steady across key regions. A 35K DWT handysize bulk carrier open in South Africa (SAFR) was fixed to ARAG at approximately $12,500.

14-June-2025

This week, the capesize bulk carrier market showed strong performance in iron ore flows, which have underpinned demand throughout the year and contributed to the recent rise in the Baltic Capesize Index (BCI) and average earnings on the Baltic Capesize Index (BCI) C5 route. Bauxite shipments also supported capesize bulk carrier employment, particularly with increased volumes from Guinea to China during Q1 2025; however, there are concerns over the sustainability of this trend into Q2 2025 and Q3 2025, as West Africa’s wet season from May to October could hamper mining operations and port efficiency at hubs like Kamsar, potentially reducing bauxite exports and capesize bulk carrier utilization in Q3 2025. Meanwhile, the strength of the Baltic Dry Index (BDI) remains heavily supported by capesize bulk carrier demand, with voyage data showing a solid 7-day moving average in iron ore shipments, reflecting consistent cargo flows. On the supply side, although there are signs of a declining number of ballast capesize bulk carriers, current market sentiment appears more demand-driven than supply-restricted, suggesting that the bullish momentum could continue if iron ore and bauxite demand holds firm. In the second week of June 2025, both capesize and panamax bulk carrier segments performed well, with the Baltic Capesize Index (BCI) hitting its highest point since mid-March 2025; capesize freight rates for Brazil–North China, Brazil–Continent, and West Australia–China routes rose in line with weekly BCI trends, showing notable $/tonne gains, while in the panamax segment, routes from the Continent and East Coast South America (ECSA) to the Far East saw modest improvements, with the Brazil–North China capesize route remaining the standout. Freight rates for the Brazil–North China capesize route rose 8% week-on-week to about $24/tonne, driven by fewer ballasters to the South Atlantic and increased daily loading volumes, which reached 1.3 million tonnes—up from under 1 million tonnes in mid-February 2025. Panamax freight rates from the Continent and ECSA to the Far East stood near $32/tonne; despite increased panamax ballasters to ECSA leading to oversupply and weaker freight returns, the high daily loading volumes indicated sustained cargo support. Supramax bulk carrier freight rates from the US Gulf (USG) to the Far East also strengthened since late April 2025, reaching around $35/tonne—nearly 7% above March 2025 levels—fueled by rebounding cargo volumes and easing oversupply, as supramax counts in USG/USEC fell from March peaks and volumes recovered through May and early June 2025. Finally, iron ore’s dry bulk tonne days, reflecting the aggregate laden time of bulk carriers, surged from mid-May lows and significantly contributed to overall dry bulk tonne day growth, with iron ore tonne days increasing 7% and the Baltic Capesize Index (BCI) rising 25% quarter-over-quarter since mid-May 2025.

13-June-2025

The Baltic Dry Index (BDI) extended its rally, reaching a more than eight-month high as freight rates strengthened across both large and small bulk carrier segments, rising by 166 points or 9.6% to 1,904, marking its highest level since 7 October 2024; the Baltic Capesize Index (BCI) jumped by 459 points to 3,555, the highest since 30 September 2024, with average daily earnings for capesize bulk carriers increasing by $3,802 to $29,481, while iron ore futures prices declined as investors awaited further clarity on U.S.–China trade discussions despite President Donald Trump’s optimistic tone; the Baltic Panamax Index (BPI) advanced by 38 points to 1,375, hitting a six-week high, with average daily earnings for panamax bulk carriers rising by $340 to $12,376, and the Baltic Supramax Index (BSI) edged up 11 points to 933, nearing a one-week high.

12-June-2025

The Baltic Dry Index (BDI) surged by 58 points to reach 1,738, its highest level since 18 November 2024, as rates improved across all bulk carrier segments; the Baltic Capesize Index (BCI) jumped 140 points to 3,096, also approaching a seven-month high, with average daily earnings for capesize bulk carriers rising by $1,160 to $25,679; iron ore futures recovered amid renewed optimism following a trade agreement between the United States and China, where President Donald Trump confirmed that the deal is finalized, including provisions for China to export magnets and rare earth minerals and for the U.S. to admit Chinese students, though lingering uncertainties and weakening steel demand tempered further gains; the Baltic Panamax Index (BPI) added 37 points to 1,337, its highest since 12 May 2025, with panamax bulk carrier earnings increasing by $338 to $12,036, while the Baltic Supramax Index (BSI) broke a six-day losing streak by rising 3 points to 922.

9-June-2025

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The capesize bulk carrier market experienced a solid upward trend this week, supported by sustained strength in the Pacific and increasing activity out of Brazil and the North Atlantic. The Baltic Capesize Index (BCI) 5TC rose from $19,071 on Monday to $23,572 by the end of the week, reflecting strong demand and tightening capesize bulk carrier availability in both basins. In the Pacific, Baltic Capesize Index (BCI) C5 rates increased from below $9.00 to levels around $10.50, driven by limited capesize bulk carrier tonnage, heightened iron ore demand, and increased engagement by miners and operators. The Brazil and West Africa (WAFR) to China Baltic Capesize Index (BCI) C3 markets picked up momentum midweek as Brazilian mining giant Vale re-entered the market and the number of capesize bulk carrier ballasters declined, lifting rates from the low $21s to the mid $24s. The North Atlantic market started the week subdued but gained strength midweek, supported by firming trans-Atlantic and East Coast Canada to China fixtures, which boosted sentiment and capesize bulk carrier rates.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The panamax bulk carrier market closed the week with notable gains, particularly on the back of renewed strength in the Atlantic. The North Atlantic saw significant rate improvements, while support from South America further boosted the panamax bulk carrier segment. A tightening of panamax bulk carrier availability midweek strengthened sentiment, with reported fixtures reflecting this trend: an 82K DWT kamsarmax bulk carrier was fixed for delivery in Spain for a trip via Colombia East Coast to redelivery Spain at around $11,000, and another 82K DWT kamsarmax bulk carrier was fixed for delivery East Coast India (ECI) via Argentina to China front-haul at around $13,000. The Pacific panamax bulk carrier market presented a mixed picture; East Coast South America (ECSA) demand helped support rates for panamax bulk carrier tonnage open in Southeast Asia, though longer Pacific round routes, especially ex-North Pacific (NOPAC) and Australia, softened into the $8,000s before showing signs of a rebound toward the week’s end. Panamax bulk carrier period activity remained quiet, although a notable fixture was reported of a newbuilding 82K DWT kamsarmax bulk carrier delivery ex-yard China fixed for one year at $13,000.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)

The ultramax/supramax bulk carrier market endured another difficult week, with rates under pressure across both the Atlantic and Pacific basins. In the Continent and Mediterranean, sentiment remained largely positional, and rates held near previously fixed levels. A 57K DWT supramax bulk carrier was fixed for delivery in Germany via the Baltic Sea to redelivery West Coast India (WCI) via Cape of Good Hope (COGH) at around $13,000. The South Atlantic and US Gulf (USG) markets continued to struggle due to oversupply, with demand insufficient to support ultramax/supramax bulk carrier rates. A 64K DWT ultramax bulk carrier was fixed for delivery Uruguay to redelivery East Coast Mexico at approximately $17,500. In Asia, the ultramax/supramax bulk carrier market remained sluggish amid reduced activity during regional holidays and weak sentiment. A 53K DWT supramax bulk carrier was fixed for delivery West Coast India (WCI) for a trip to Vietnam at about $6,500.

Handysize Bulk Carrier Market – Baltic Handysize Index (BHSI)

The handysize bulk carrier market showed mixed results this week, with flat overall sentiment across regions. In the Continent and Mediterranean, the market remained soft with limited visible activity. A 37K DWT handysize bulk carrier was fixed for delivery Denmark to redelivery Portugal at around $9,500. The South Atlantic and US Gulf (USG) maintained stable conditions, supported by balanced tonnage and moderate fresh demand. A 39K DWT handysize bulk carrier was fixed for delivery US Gulf (USG) to redelivery East Africa (EAFR) at approximately $16,000. In Asia, the handysize bulk carrier market remained steady. Although the list of handysize bulk carrier tonnage grew gradually, modest demand helped hold rates stable. No major changes in cargo flow were observed to push rates significantly higher. A 39K DWT handysize bulk carrier was fixed for delivery Indonesia via Australia to redelivery North China with grains at $12,000.

7-June-2025

The Baltic Dry Index (BDI) rose on Friday, recording its strongest weekly increase since early March 2025, supported by firmer panamax bulk carrier rates. The Baltic Dry Index (BDI) climbed 7 points to 1,633, reflecting a weekly gain of approximately 15%. The Baltic Capesize Index (BCI) slipped 3 points to 2,842, breaking a seven-session winning streak, though it still ended the week nearly 25% higher. Average daily earnings for capesize bulk carriers declined slightly by $20 to $23,572. The Baltic Panamax Index (BPI) advanced 35 points to 1,246, achieving a weekly rise of 8.2%—its best performance since late April 2025. Average daily earnings for panamax bulk carriers increased by $311 to $11,210. The Baltic Supramax Index (BSI) fell 3 points to 933, the lowest level since 14 March 2025, closing the week with a decline of nearly 2%.

31-May-2025

The Baltic Dry Index (BDI) climbed 65 points on Friday to 1,418, marking a 5.8% weekly gain and reaching its highest level since 2 May 2025, primarily driven by stronger capesize bulk carrier rates. The Baltic Capesize Index (BCI) rose by 218 points to 2,277, recording a 20% weekly increase and hitting its highest level since 3 April 2025, as average daily earnings for capesize bulk carriers increased by $1,811 to $18,885. The rise in capesize rates was supported by stronger coal shipments from Australia and elevated bauxite rates ahead of Guinea’s rainy season in August, though further gains may be limited, with rates unlikely to surpass the $20,000 per day mark. Iron ore futures edged down and posted weekly losses due to softer demand in China and ongoing trade uncertainty. Meanwhile, the Baltic Panamax Index (BPI) fell 18 points to 1,119, reflecting a 10% weekly decline, with average daily earnings for panamax bulk carriers slipping by $163 to $10,071. The Baltic Supramax Index (BSI) dropped 5 points to 951, down 3% over the week.

30-May-2025

The Baltic Dry Index (BDI) rose by 50 points on Thursday to reach 1,353, its highest level in nearly two weeks since 16 May 2025, driven by gains in the capesize bulk carrier segment, as the Baltic Capesize Index (BCI) advanced 185 points to 2,059, the strongest level since 2 May 2025, with average daily earnings for capesize bulk carriers increasing by $1,535 to $17,074. Iron ore futures ended a four-day losing streak, supported by improved sentiment after a U.S. federal court blocked the implementation of President Donald Trump’s tariffs. Forward Freight Agreements (FFAs) reflect expectations for stable panamax and supramax rates for the remainder of 2025, while capesize bulk carrier freight rates may continue to firm. On the other hand, the Baltic Panamax Index (BPI) declined 32 points to 1,137, hitting its lowest point in more than two months since 11 March 2025, with average daily earnings for panamax bulk carriers falling by $288 to $10,235, while the Baltic Supramax Index (BSI) dropped 8 points to 956, nearing a four-week low.

28-May-2025

The recovery of the dry bulk market has driven a notable increase in dry bulk carrier values, underscoring the fundamental link between spot market performance and asset pricing in dry bulk shipping; an analysis of average monthly data from August 2015 to May 2025, focusing on the Supramax Timecharter Average (S10TC) and the market value of a 15-year-old supramax bulk carrier, highlights consistent patterns and key inflection points that illustrate how today’s S&P (Sale and Purchase) market reflects evolving valuation dynamics, with a strong statistical correlation of 0.65 between the Supramax Timecharter Average (S10TC) and supramax bulk carrier prices indicating that rising earnings generally lead to higher asset values, although the correlation is imperfect and reveals the influence of factors such as sentiment, forward-looking expectations, and broader economic and regulatory conditions; reviewing year-to-date average charter rates and asset prices from 2016 to 2025 shows a clear alignment, as both metrics fell to historic lows in 2016, with 15-year-old supramax bulk carriers valued under $4 million, followed by a sharp rebound in 2017–2018 where both rates and prices nearly tripled, and during the 2021–2022 supercycle driven by pandemic-related disruptions and a global commodities rally, the Supramax Timecharter Average (S10TC) exceeded $30,000/day and supramax bulk carrier prices surged to $18 million, whereas in Q1 2025, despite rates easing to slightly above $7,000/day, asset values have remained elevated, reflecting a shift toward a new price baseline shaped by supply constraints and long-term structural factors; comparing market behavior across different cycles reveals a substantial repricing of vintage tonnage, as a Japanese 15-year-old supramax bulk carrier earning $10,000/day would have sold for $8.5–9.5 million in 2018–2019, but in 2025 the same earnings environment supports values exceeding $15 million—an increase of approximately 60 percent—while in 2016, with the Supramax Timecharter Average (S10TC) near $5,000/day, these ships sold for $5.5 million, and by 2020, even during temporary market downturns, prices seldom dropped below $7 million; the rise in asset values can be attributed to several converging trends including increased newbuilding costs driven by inflation and higher steel prices, a historically low orderbook reflecting ongoing supply discipline, and regulatory uncertainty that enhances the appeal and premium of existing tonnage, prompting shipowners to prioritize replacement cost and long-term market tightness over near-term returns; over the past decade, the dry bulk sector has undergone not only cyclical shifts in rates and values but also a fundamental revaluation of aging tonnage, with the current S&P market shaped by inflationary pressure, regulatory risk, and constrained supply of new ships, all of which support elevated valuations even in a subdued earnings environment, rewarding early investors who entered during prior downturns while presenting challenges to new buyers navigating a high-valuation landscape that reflects both present market realities and an outlook of sustained structural tightness, though any reversal in sentiment or earnings could, as history shows, still prompt a market correction.

19-May-2025

An analysis of the panamax bulk carrier sector reveals shifting dynamics in newbuilding activity, demolition levels, and asset values, with values trending downward across most sub-sectors and age categories compared to the same period in 2024; notably, older 15-year-old panamax bulk carriers have recorded the steepest decline, dropping by -18.14% year-on-year from a high of USD 18.14 million in 2024 to USD 14.85 million today, while 3-year-old panamax bulk carriers have appreciated in value by +4.87%, rising from USD 40.04 million to USD 41.99 million, a reflection of buyer preference for modern, efficient tonnage amid subdued overall market activity; secondhand sales have decreased by -13%, with 85 panamax bulk carriers changing hands so far in 2025 compared to 98 during the same period last year, and newbuild orders have seen an even sharper contraction of -73%, with just 19 new contracts reported to date, underscoring the cautious sentiment prevailing among shipowners, especially as panamax bulk carrier one-year Time Charter rates have fallen by -29% year-on-year to approximately USD 11,850 per day; despite this downturn in earnings, demolition activity remains limited, with slightly elevated but still historically low levels as shipowners continue operating their panamax bulk carriers to maximise returns, even in a softer rate environment, indicating a general reluctance to scrap tonnage and a strategic focus on extracting residual value from aging assets; the panamax bulk carrier fleet is ageing, with a considerable share of ships approaching or exceeding the 15-year mark, and although current conditions have not yet triggered widespread demolition, the medium-term outlook suggests a growing need for fleet renewal, presenting a potential opening for investors targeting modern ships; the panamax bulk carrier sector offers some optimism as newer tonnage has retained or increased in value, while slower activity in secondhand transactions and newbuild commitments reflect a prudent stance in an uncertain market, with sustained interest in younger ships and limited fleet expansion reinforcing the investment case for newer panamax bulk carriers as market fundamentals continue to evolve.

4-May-2025

The shipping freight market continues to be challenging to navigate due to its constant fluctuations, with the dry bulk segment offering a clear example where seasonality, once the primary driver, is now matched in importance by policy developments. Typically, seasonal cycles influence rate behavior, with April to May acting as a transitional phase between winter energy demand and the summer’s agricultural and industrial activity. To evaluate if this period consistently reflects market weakness or stability, an analysis of Baltic Exchange Time Charter Averages (TCA) from 2017 to 2025 was conducted, comparing April–May data to annual trends. The Baltic Capesize Index (BCI), heavily influenced by iron ore and coal shipments, showed notable volatility, with April–May rates falling below yearly averages in 2017, 2018, and 2024, aligning with post-Q1 slowdowns in Chinese iron ore imports. However, in 2021 and 2022, BCI held closer to annual averages due to factors like port congestion and China’s stimulus measures, suggesting that while spring can sometimes offer support, it more often signals a market breather than a breakout. The Baltic Panamax Index (BPI), tied to grain, coal, and minor bulk trade, displayed less volatility but experienced modest spring downturns, notably in 2023 amid weak grain exports from South America and ambiguous trade policies; though a partial recovery occurred in 2025, spring rates still lagged behind the yearly average, reflecting regional vulnerability to agricultural and Atlantic demand shifts. In contrast, the Baltic Supramax Index (BSI) and Baltic Handysize Index (BHSI) showed greater consistency, with April–May performance in 2017, 2020, and 2022 closely tracking annual averages, highlighting the more stable, regional trade patterns and reduced exposure to the major fluctuations affecting larger vessels. This relative steadiness in supramax and handysize markets may stem from their reliance on coastal and intra-Asian trades that follow different dynamics than long-haul capesize or panamax routes. Overall, while April and May seldom mark the lowest points of the year, they often represent a pause rather than momentum, especially for larger bulk carriers, though broad conclusions must be drawn carefully. What has become increasingly apparent is that seasonal trends alone no longer dictate market direction, with external factors—particularly political decisions—playing a growing role. For example, tariff actions from U.S. President Donald Trump, including those targeting China and key industrial goods, have the potential to disrupt dry bulk flows of coal, steel, and grain, potentially dampening ship orders or altering trade routes. Such developments highlight how even historically predictable periods like spring are now shaped as much by political forces as by seasonal ones, emphasizing the need for close monitoring of policy shifts alongside traditional market indicators in a world where trade wars can rapidly upend the shipping industry’s supply-demand balance.

3-May-2025

The Baltic Dry Index (BDI) inched up on Friday, posting a weekly gain as demand for capesize bulk carriers strengthened. The Baltic Dry Index (BDI) increased by 10 points, or 0.8%, closing at 1,421 and registering a 3.5% rise over the week. The Baltic Capesize Index (BCI) advanced by 36 points, or 1.8%, to 2,079, bringing its weekly increase to over 10%. Average daily earnings for capesize bulk carriers rose by $300, reaching $17,241. Meanwhile, the Baltic Panamax Index (BPI) declined by six points to 1,368, reflecting a 1.8% drop for the week. Average daily earnings for panamax bulk carriers decreased by $52 to $12,310. The Baltic Supramax Index (BSI) dipped by one point to 955, with a weekly decline of 2.6%.

1-May-2025

On 1 May 2025, the Baltic Dry Index (BDI) increased by 25 points, reaching 1,411 points. The Baltic Dry Index (BDI) previously reached its highest level on 20 May 2008, peaking at 11,793 points, while its lowest point was recorded on Wednesday, 10 February 2016, when the Baltic Dry Index (BDI) declined to 290 points.

1-May-2025

The Baltic Dry Index (BDI) declined on Wednesday as all ship segments posted losses, with the Baltic Dry Index (BDI) falling by 12 points to 1,386 and the Baltic Capesize Index (BCI) dropping 17 points to 1,961, while average daily earnings for capesize bulk carriers slipped by $143 to $16,265. The supply and demand balance in the dry bulk market is expected to weaken in both 2025 and 2026. A shift in U.S. trade policy has worsened the economic outlook and increased uncertainty, as the United States Trade Representative (USTR) announced additional tariffs on China-linked ships last week, despite easing port fees on ships built in China. The Baltic Panamax Index (BPI) declined by 9 points to 1,380, with average daily earnings for panamax bulk carriers falling by $81 to $12,423. The outlook for the panamax bulk carrier segment is forecast to be the weakest, given that coal, which makes up more than half of its cargo, is seeing reduced demand. On the other hand, limited fleet expansion in the capesize bulk carrier segment could help maintain relatively stronger freight rates. Iron ore futures edged lower for a third straight month amid prospects of steel production cuts in top consumer China and softer demand ahead of the Labour Day holiday. Meanwhile, the Baltic Supramax Index (BSI) fell for the third consecutive day, losing 10 points to 957, and the Baltic Exchange will be closed on Thursday in observance of Labour Day.

Capesize Bulk Carrier Market – Baltic Capesize Index (BCI)

The Capesize Timecharter Average (C5TC) recorded a week-on-week decline of $1,507, closing at $22,190 on Friday. In the North Atlantic, several INL breaching front-haul cargoes with mid-April loading were concluded, with the Baltic Capesize Index (BCI) C9 route reflecting $42,313 by week’s end. In Brazil, freight rates began to recover mid-week as additional cargoes entered the market with second-half April laycans. Market discussions pointed to a limited number of ballasters arriving toward the end of April. The Baltic Capesize Index (BCI) C3 route closed the week up by $0.405, reaching $24.485. In the Pacific region, the laycan window for the Baltic Capesize Index (BCI) C5 route has fully transitioned to April dates. Despite this, the week was relatively slow, with mining companies largely absent from the market for various days. The Baltic Capesize Index (BCI) C5 route was assessed at $9.35.

Panamax Bulk Carrier Market – Baltic Panamax Index (BPI)

The Panamax sector experienced a week of gradual decline, despite limited resistance and some upward movement in Forward Freight Agreements (FFAs). The North Atlantic continued to show weak demand, exerting downward pressure, and few significant fixtures were reported. Activity originating from North America introduced some uncertainty, but by week’s end, spreads showed signs of stabilization as the market awaited more concrete developments. A Kamsarmax bulk carrier of 82,000 DWT was reported fixed at $17,000 for a trip via Northern Central South America with redelivery to Singapore-Japan. The South American market remained active, with varied freight rates for front-haul voyages. For index dates, the average hovered around $12,000 to $12,500. In Asia, the market was mixed, with different rate levels observed for longer round trips. Rates ranged from $12,500 to $15,500 for well-maintained grain-clean tonnage from the North Pacific. Period activity remained limited; however, a notable fixture involved an 82,000 DWT vessel open in China securing $17,000 for a three-to-five-month period.

Ultramax/Supramax Bulk Carrier Market – Baltic Supramax Index (BSI)